Optimize Subscription Management

Automate Recurring Billing, Invoicing, and Reporting in Dynamics 365 using Subscription & Recurring Billing Management

What's Subscription and Recurring Billing Management?

Manual billing in CRM leads to revenue leakage, missed payments, and inefficiencies, slowing subscription-based businesses. Inogic’s Subscription and Recurring Billing Management App solves these gaps by automating invoicing, managing pricing models, handling regional taxes, and reducing billing errors. Features like proration, trial tracking, and renewal reminders simplify subscription management. Dashboards provide clear insights into key metrics like ARR, Churn rate, etc., supporting better financial decisions. Automate your billing processes and focus on scaling your business with ease.

Recent Updates

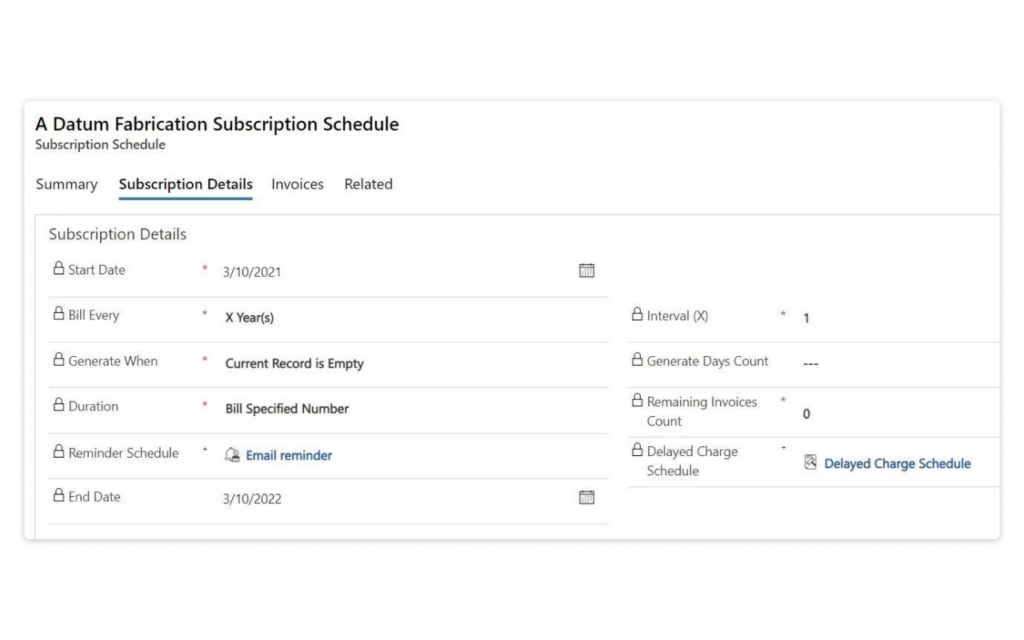

Support to schedule automatic reminders to notify customers and users (subscription schedule owners) about subscription renewals

Supports end-to-end management of customers’ subscription cycles and revenue analysis through comprehensive dashboards.

Keep track of trials and extend trials as per customer requirements

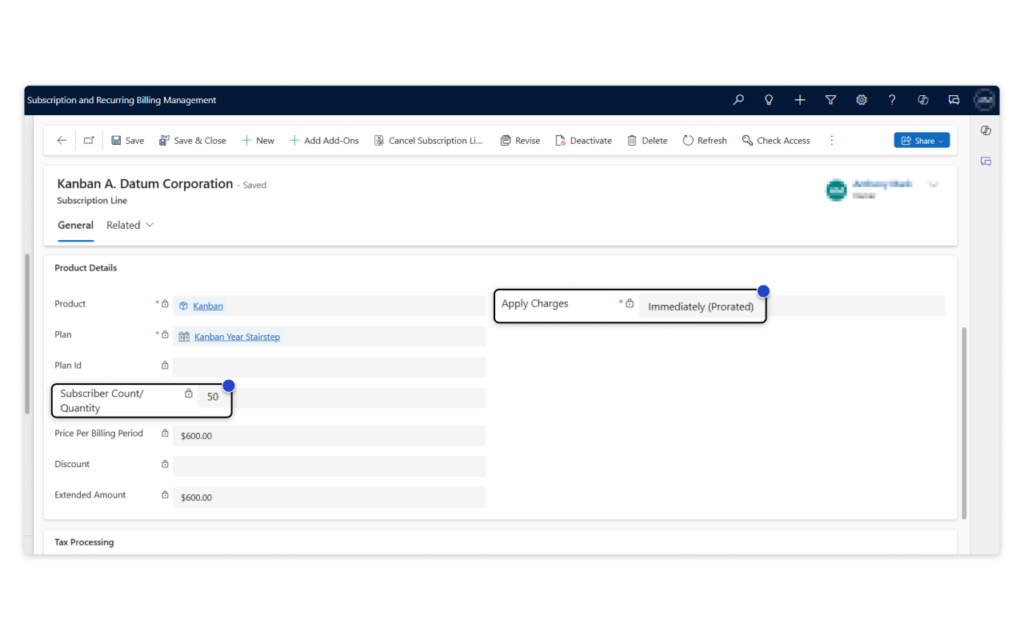

Provision to calculate subscription charges on pro-rata basis

Information Vault

Benefits of using Subscription and Recurring Billing Management

Automate subscription management to reduce manual work, giving you more time to focus on scaling your business.

Prevent missed payments and strengthen customer loyalty with seamless trial tracking and timely renewals.

Offer flexible pricing and subscription options to meet diverse demands and grow your business effortlessly

Leverage real-time insights and key metrics to plan confidently and drive sustained growth.

Supported On

Dynamics 365 CRM

Online | On-Premises

Features

Here’s How You Automate Subscription and Billing processes

Automate Subscription and Billing processes in Dynamics 365 CRM

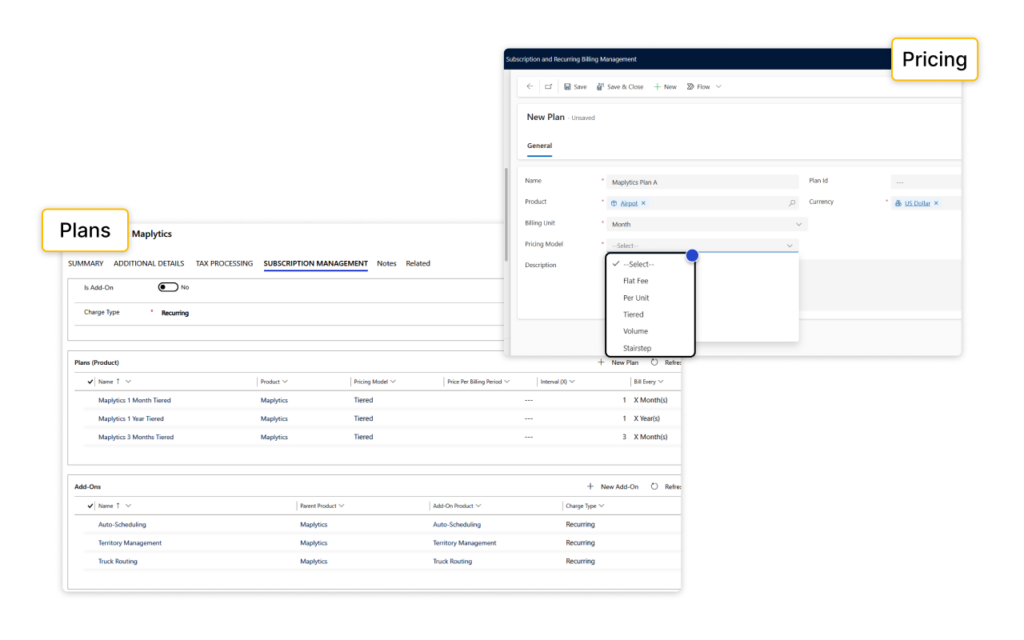

Save time and reduce errors by automating the generation of invoices and sales orders for ongoing and new subscriptions. Tailor pricing plans and add-ons to better segment customers, boost upselling opportunities, and improve cash flow.

More Features

Automate Tax Calculation

Ensure accurate and region-specific tax compliance by automating tax calculations for quotes, orders, and invoices, reducing errors and manual effort.

Track Trials

Seamlessly manage free trials or extend them to enhance customer experience and drive conversions, ensuring no trial opportunity is missed.

Renewal Reminder

Keep subscriptions active by sending automated reminders for renewals and due payments, avoiding lapses and maintaining consistent revenue.

Plans & Add-Ons

Create diverse pricing plans and add-ons to meet customer needs. Segment effectively, boost upselling, and improve cash flow for growth.

Revenue Analysis

Track metrics like MRR, ARR, and CLTV on a detailed dashboard. Identify issues and take steps to reduce losses and improve performance.

Manage Trials

Easily create, extend, and convert trials to subscriptions, ensuring smooth transitions and improved customer retention. Track all trial details in one place for better management.

testimonials

What Our Customers Are Saying?

Frequently Asked Questions

Subscription and Recurring Billing Management provides detailed reports of important SAAS metrics such as MRR, AAR, ARPU, CLTV, Customer Churn Rate, Subscriber Churn Rate, Total active subscribers and Credit Notes for in-depth revenue analysis.

No, there is no such limit. With its support for multiple plans, add-ons and multiple pricing models, Subscription and Recurring Billing Management enables users to easily manage vast scale of subscriptions.

The frequent changes in subscriptions will not affect the billing cycle or create any complications in calculating subscription charges. The ‘Proration’ feature of Subscription and Recurring Billing Management ensures smooth billing cycle and easily adjusts the billing amount as per the upgrade/downgrade requirements put forth by the customers.

Yes, it is quite easy to keep track of all different regional taxes with Subscription and Recurring Billing Management. With its integration to AvaTax by Avalara and automation of tax calculations, there is no need to worry about different regional tax rates and tax accuracy.

Recurring billing focuses on managing repeat payments, while subscription billing covers pricing models, trials, renewals, and revenue tracking.

With the Subscription and Recurring Billing Management App, you can automate both the payment models, including the tasks of invoicing and collecting subscription revenue in Dynamics 365 CRM.

Reach out to us today to know more!