Though Dynamics CRM allows for creating Quotes, Orders and Invoices from within CRM it does not provide a true accounting solution that would automatically calculate the tax as well on the transaction. It provides a tax field on the transaction forms but the value has to be manually entered by the users. For organizations that choose to use CRM for initial order entry for their sales rep, it might help to be able to automatically calculate the tax on the transaction as well.

If you are using QuickBooks to manage your accounts, InoLink would help you with your tax calculations from right within Dynamics CRM. InoLink is an integration tool designed to link Dynamics CRM with Intuit QuickBooks to enable complete access to accounting details to authorized salesrep from right within Dynamics CRM.

InoLink syncs the Sales Tax code of the Customer in QuickBooks to the CRM Account. Also when bringing over Product information from QuickBooks, it also bring over the sales tax details for the product.

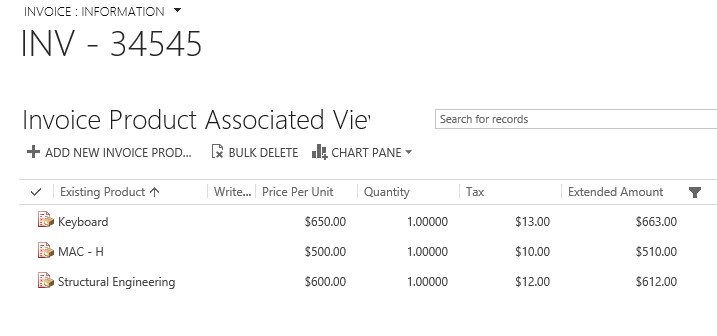

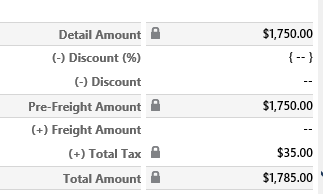

You can enable the global setting in InoLink to calculate tax for transactions. Now when you create a Quote/Order/Invoice in CRM, the tax would be automatically calculated by reading the tax information of the customer as well as the individual products added to the transaction. Here is how the transaction would appear with the tax automatically calculated.

This way InoLink would let you generate the accurate orders with the tax component calculated automatically. To test drive InoLink on your system request a trial today!